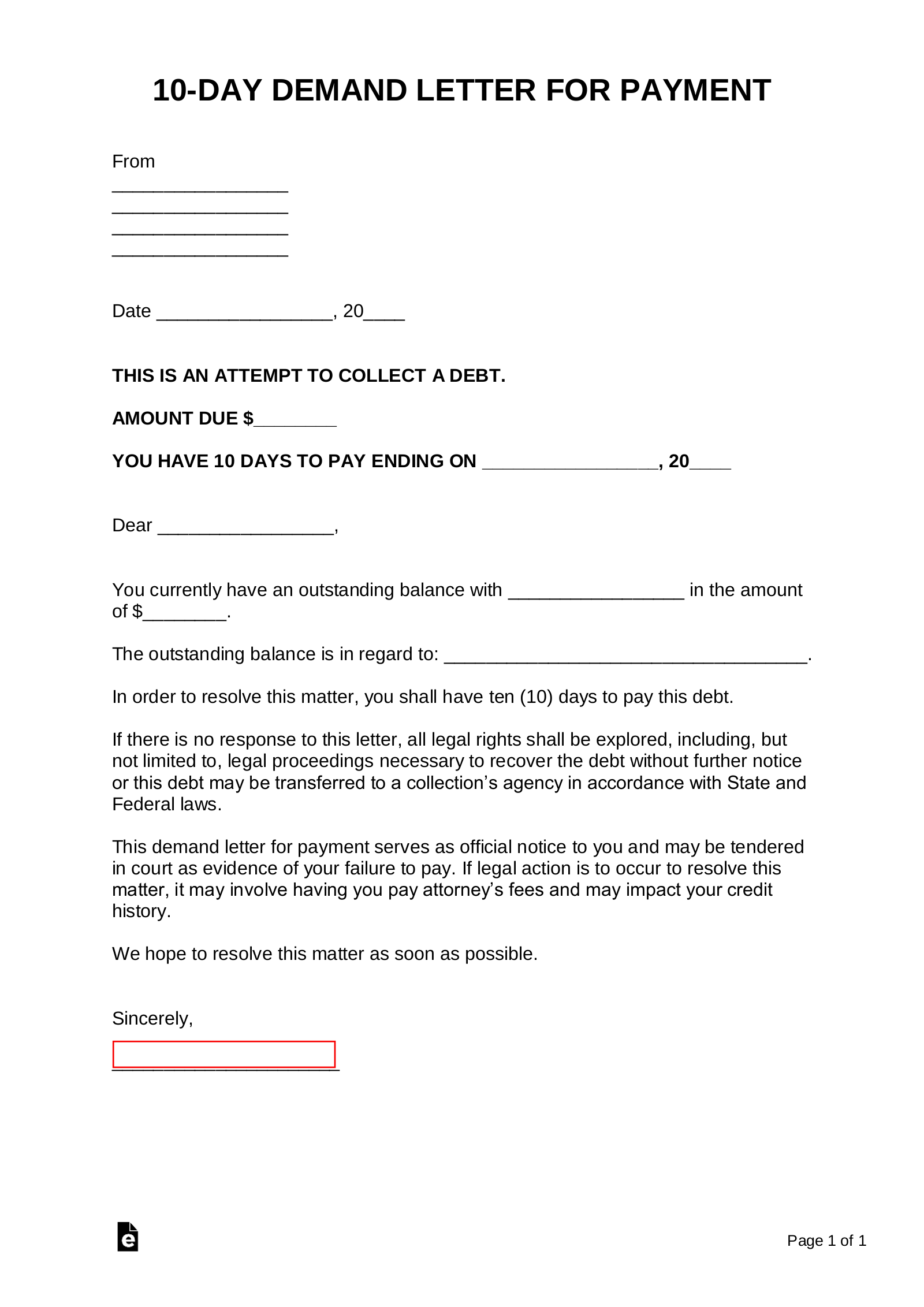

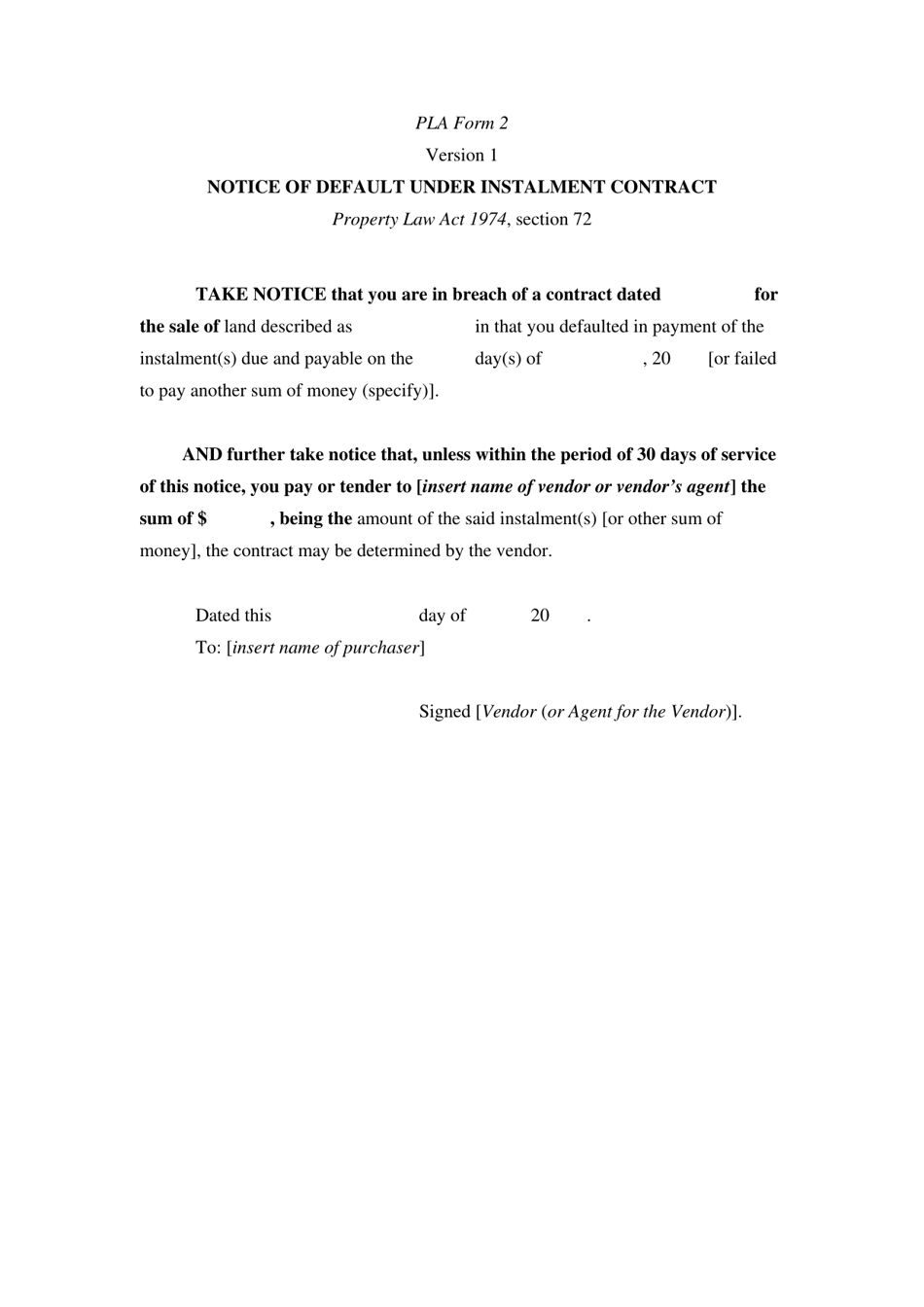

It can help to familiarize yourself with the nonjudicial foreclosure process if you live in a state that permits these processes. Signed a mortgage loan with a power of sale clause. Live in a state that follows nonjudicial foreclosure, and If you've received a notice of default, you likely: The foreclosure process varies within each state. Depending on state law, you may have as little as a few weeks to resolve your outstanding balance in order to avoid foreclosure. If you've received a notice of default, you should understand that the next step for your lender is to begin the foreclosure process. Instead, it serves as notice that you are behind in your payments and that your property may be sold as a result of foreclosure if you don’t act soon. Technically speaking, a notice of default is not a foreclosure. Because these notices are publicly reported, this turn of events will have a negative impact on your credit score. If you have received one of these notices, that means that your property is in pre-foreclosure. This is a final warning before the mortgage company begins to foreclose on a borrower’s property. It also describes the affected property and gives a deadline for paying the delinquent amount. Generally, the notice states the amount owed and the borrower’s and lender’s contact information. Sometimes it is also published in a local newspaper or on a county website. Though it is a public record, borrowers receive a copy by mail and/or posted at their property. What Is a Notice of Default?Ī notice of default is filed by a mortgage trustee with a borrower’s local property records office. Below, we will explain how to understand the information contained within this notice and the steps you should take if/when you receive one.

Once you've received a notice of default you’ll want to act quickly to take advantage of options available to you. Through foreclosure proceedings, a mortgage company can eventually take ownership of your property and sell it. This is your mortgage lender’s way of telling you that you have one last chance to address overdue mortgage payments before your lender will foreclose on your home.

If you've received a notice of default you shouldn't ignore it.

If You Want To Avoid Foreclosure but Can’t Keep Your Home.If You Want To Avoid Foreclosure and Keep Your Home.Information That Will Be in the Notice of Default.

0 kommentar(er)

0 kommentar(er)